The 6 factors that determines the price of real estate in Nigeria is a trade secret.

Every industry has what is called their ‘trade secret’, something that only the initiated and well connected inside big players in the industry are supposed to know. Something that the public must be kept in the dark about.

These trade secrets can be a method, a technique, a process, research and analysis data, a formula, a recipe, a device, an instrument, etc.

Some popular examples include the Coca Cola Formulation or KFC’s 11 herbs and spices amongst others.

Today I will be sharing a trade secret with you, a trade secret that you aren’t supposed to know about. A trade secret about the inner workings of property pricing in the Nigerian real estate market.

In this article I will reveal the 6 factors that determine property prices in Nigeria. All the factors that real estate developers and seasoned real estate investors consider when pricing their properties.

In the Bible when God first talked to Moses from the burning bush, He told him to take off his sandals because where he was standing is a sacred ground.

This is obviously not of the same magnitude as a personal tete-a-tete with God nonetheless I will still warn you to brace yourself and pay undivided attention because what you are about to learn is a highly coveted trade secret that won’t just give you a massive edge when acquiring properties but also enable you to accurately price your own properties whenever you decide to sell.

📍First thing that determines price of properties is the purchasing power of money:

When setting the price of properties one of the first things that investors and property developers consider is the current purchasing power of Naira compared to the purchasing power of Naira at the time they acquired or built the property.

In a highly inflationary economy like Nigeria, the easiest way to make a loss on a property investment is, you guessed it, through inflation.

For example let’s say you acquired the property for 40M last year and you resell it this year for 50M, on paper you made a profit of 10M but in reality you made a loss because adjusted for inflation, 40M last year will be like 55M-60M this year.

The first factor that developers and investors consider when pricing their properties is the value of money when they bought or built the property adjusted to the current value of money today then adding whatever amount to make profit based on the next factor that I discuss below.

2. 📍Income class being targeted:

A 4 bedroom luxury penthouse at Sujimoto’s Lucrezia located at the heart of Banana Island is selling for $14 Million, yes you read it right. A 4 bed penthouse in Nigeria is selling for 14 Million USD. As am writing this a dollar is N1, 500 so you can do the calculations.

I can imagine the things that came into your mind as you read this, the property is overpriced. Sujimoto is insane! But the truth is, the property is not overpriced, not for the income class that it is meant for.

It is “overpriced” for 99.5% of Nigerians but that’s okay because they are not the income class that Sujimoto was thinking about when he was building the property.

In fact, he wasn’t even targeting the top 1% of Nigerians. He is targeting the top 1% of the top 1% of Africans. That is the income class that he is targeting and that is what gave him the morale to price his 4 bed penthouse for $14 Million USD. For the income class he is targeting, the price is right.

This is another factor that determine property prices. What set of people are being targeted? What income class are being targeted?

This is the reason behind most of the properties people like to say are “too expensive” or “overpriced”. They are not overpriced, if you think they are overpriced or too expensive, what it simply means is that you are not part of the income class being targeted. It is quite that simple.

If you are a developer or investor selling land and the price of a plot is 4M with 12 months payment plan, what it means is that you are targeting the masses, those with a monthly income of 500k to 1M while on the other hand if you like Pastor Mathew Ashimolowo, the developer of Makarios estate is selling a plot of land at Ibeju-Lekki for $100,000 USD then you are targeting the top 1% of income earners.

So when setting the price of their properties, a major factor that developers and investors consider is the income class they want to target. This is very important because if you are targeting the masses and your price is high, they won’t buy because they like cheap things.

On the other hand if you are targeting the high income earners and your pricing is cheap, they won’t buy because they prefer exclusivity and cheapening the price entry of your products so that any Dick and Harry can afford it means that it is no longer exclusive.

After considering the income class you want to target, another important factor that determines the price of a property and affects the income class you can target is.

3. 📍The location

You might have heard the saying, “real estate is about location, location, location”. It is true. Another factor that developers and property investors consider when pricing their properties is the location.

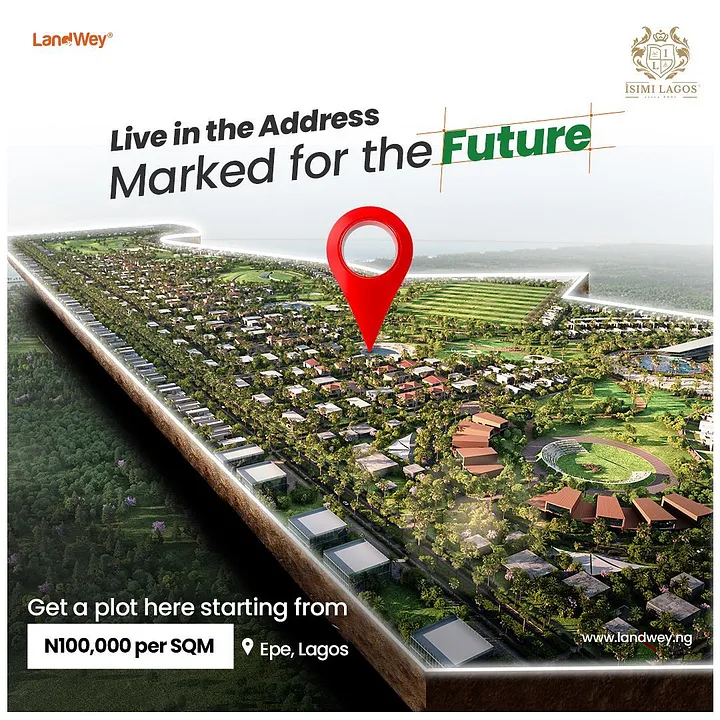

The level of development that is in the location their property is. N40 Million Naira can buy you acres of land at Epe. That same 40 Million cannot buy you even half a plot at Lekki. Same amount of money, different locations.

Earlier in this article I told you about Sujimoto who is selling a 4 bed penthouse at his masterpiece, Lucrezia, located at Banana Island for 14 Million USD. Remember I told you that the reason his penthouse is priced at $14M is because he is targeting the top 1% of the top 1% of Africans.

Now why did he build Lucrezia at Banana Island instead of Lekki Phase 1, or Ajah or Ikeja? It is because the income class he is targeting aren’t interested in living in Lekki or Ajah, God forbid, Ikeja? No!

He is targeting the richest of the rich so he must build at an extremely exclusive location where the richest of the rich live. From this you can see that income class and location are linked. They go hand in hand.

When pricing a property, the location is a major factor. Is the location developed? What level of income earners live or want to live there? If high income earners live there, it simply means that more high income earners will want to live there so you can call any price you want and get it.

That is why a 4 bedroom fully detached house at Lekki Phase 1 can be selling for ₦300 million, even ₦600 million depending on where exactly it is located while same property at Ikorodu at best will sell for ₦60 million.

It is not wickedness or greed on the part of developers and investors. It is not their fault at all, after all, ‘real estate is all about, location, location, location’.

4. 📍Value added:

Most times people forget that developers and property investors are not in the business of real estate for charity but instead to make money. The more values, the more amenities they add to their properties the higher they will charge for it so they can make profit.

That is why serviced plots will always be more expensive that ordinary plots. This is why developers increase the price of the plots of lands in their estate the more they work on, add amenities and develop the estate.

That is why a 4 bedroom fully detached duplex with infinity pool, jacuzzi, cinema room, BQ and 24/7 power will always be more expensive that a 4 bed with no pool, no jacuzzi, no cinema room, no BQ even if they are directly opposite each other. This is basic economics. Economics 101.

5. 📍The title document on the property:

A friend of mine once wanted to acquire land. One developer told him N30M for a plot, the second developer told him 10M. Those properties are directly opposite each other, only difference was that the one selling for N30 Million had C of O, the other selling N10 Million didn’t.

The more perfected and secure the document of a property is, the more expensive it will be. Another factor that determine the price of a property is the title document on it.

Most lands in Epe currently are still reasonably priced and affordable which is why I advise people to acquire as many as they can now because by the time C of Os are issued for these lands, a land currently selling for 4M will be selling 12M and above.

6. 📍The law of demand and supply:

Just like every other business, real estate is not exempt from the law of demand and supply. After considering the purchasing power of money, the income class being targeted, the location, the value added and the title document on the property, the last thing that determines the price of the property is the law of demand and supply.

Developers and investors after considering the factors I mentioned above and putting their properties on the market, if the demand is high and they are fast selling, they will increase the price of the property, for no reason other than the high market demand.

The bigger the demand the more they increase their prices. When Mathew Ashimolowo launched Makarios estate, a full plot was selling for N53M or thereabouts but he was selling so much he closed land sales, today he has re-opened land sales and increased the prices unreasonably, at least to people who don’t understand those things. A full plot is selling for $100,000 which is N150M.

If on the other hands demand is low and there is little sales, the developers and investors will adjust their prices downward to stimulate and encourage sales.

This follows the law of demand and supply which says that the higher the demand for a product, the higher the price and the lower the demand for a product the lower the price.

These are the 6 factors that determine the price of properties in the Nigerian real estate market.

I am, Ugochukwu.