In 2020, the average rent prices for a 2 bedroom apartment in Lekki Phase 1 was just ₦5 million, fast forward to today in 2024 the average price of rent for a 2 bedroom apartment in this same Lekki Phase 1 is ₦9 million.

This represents an 80% increase in the price of rent or as we in the property industry like to call it, this reflects an 80% appreciation in the rental value of 2 bedroom apartments in Lekki Phase 1.

80% in just 4 years, that’s massive! Very massive.

When this figure is broken down further, you will see that the rental value for 2 bed apartment here is appreciating per annum by 20%, at this rate, you will see that by this time in 2028 rent prices for a 2 bedroom apartment in Lekki Phase 1 will be about ₦19 million per annum.

If you are an investor, feel free to take this as your sign to buy apartments in Lekki Phase 1 and make some high returns. You can reach out to me, I got some great properties.

Back to our discussion.

From ₦5 million in 2020 to ₦19 million in 2028. Now the question is, what is behind this increase in rent? What is driving this increase?

Looking at the price upshot, it is so easy and convenient to blame landlords and label them as heartless and unreasonable but is it really their fault?

Is the blame to be laid at their feet or are there other factors at play?

This is what I will be analyzing in detail in this article. Whether you’re a prospective tenant or a real estate investor, understanding the dynamics behind rental price increases is essential to navigating this evolving market.

As a tenant, knowing the factors behind the increases in the rent prices that you pay is important and as a real estate investor knowing the factors that you need to consider when setting the rental value and price of your properties is a big MUST, otherwise you are liable to lose a lot of money.

Just like every other thing in this world, when it comes to the rental value of a property, there are more than one factor at play. In the case of rental value, there are 5 different and distinct factors that determine the value.

Put your feet up on a chair and make yourself as comfortable as you can as I analyze all 5 factors one by one starting with.

1🔹 The Purchasing Power of Naira – How It Affects Rent Prices

What you might or might not be aware of is that money has two values. The numerical value and the purchasing value. The numerical value is simply the figures on that note you are holding.

For example, ₦1,000 note will always be a ₦1,000 note because 1,000 is its numerical value. By this time is 2022, fuel was just ₦195.29 per liter so with ₦1,000 you could buy 5 litres of fuel.

Today as I am writing this, a litre of fuel in my city is about ₦1,300 per litre. I heard that in some places like Nasarawa it is even as high as ₦1,770 per litre.

Same ₦1,000 note. 2 years ago, it could buy you 5 litres. Today it can’t even buy you 1 litre. Same numerical value, different purchasing power.

The purchasing power of any country’s currency is like the lifeblood of that country’s economy. When it is full and healthy, the economy is strong and robust but when it isn’t? Well, Zimbabwe remains a great cautionary tale.

The purchasing power of money determines the prices of goods, services, rents and basically every other thing.

The Naira’s purchasing power over the past 2 years has been plummeting at a worrying rate, this has been leading to more and more increase in the prices of everything else, rent included.

One of the beautiful things about real estate is that it always stays ahead of inflation, so the more inflationary actions cause an increase in prices of basic amenities the more the price of real estate skyrockets to keep up.

As long as the purchasing power of Naira keeps dropping, rent will keep increasing. There are no two ways about that. It is not specific to Nigeria, it is a worldwide economic reality. All things being equal, decrease in the power value of a currency will lead to increase in rent.

Real estate must be a step or two ahead.

This is the first factor that determines the rental value of properties, it is the first but not the only one.

As an investor, when determining the rental value of your properties, the first thing you should consider and from there make an informed decision is the purchasing power of Naira or whatever currency applies to you.

2🔹 The Cost of The Land and The Cost Of Construction

Houses are not built on air and like George Orwell said in his book, The Animal Farm, “All animals are equal, but some are more equal than others”.

Land is land but of course some land in some locations are more valuable than others thus much more expensive.

The price of the land a house sits on and the final cost of building that house plays a crucial role in determining the rental value of that house due to profitability. As a landlord you of course have to look at what a project costs you when making the decision of how much you will collect as rent on it.

The major purpose of investing in real estate at the end of the day is to make money. To get healthy returns on your investment so the higher the cost of a land, the higher priced whether for sale or rent the house built on it will be.

The rental market here in Nigeria is primed for more increases because at the moment the cost of building materials is at an all time high, when all the houses currently being built finally hit the market. You can’t rent them at the old prices, their rental prices must reflect the extra-expenses they took in the course of construction.

I don’t think this requires any more explanation as it is basically economics 101. So let’s move on to the third factor.

3🔹 The Location

Real estate is about one thing, location, location, location!

At the beginning of this article I analysed the rental value of a 2 bedroom apartment in Lekki Phase 1 over the past 4 years. I told you that in 2020, on average it was ₦5 million and is now ₦9 million.

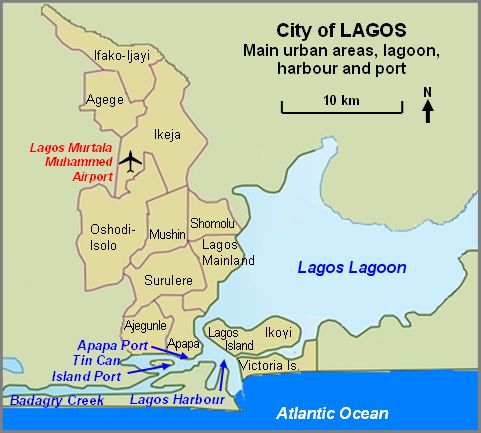

Now let’s go to Ajah, Lagos state.

In 2020 on average a 2 bedroom apartment was renting for ₦700,000. Today in 2024, same location on average a 2 bed there is now letting for ₦2 million. ₦2 million is quite a distance and a far cry from the ₦9 million same 2 bed apartment is renting in Lekki Phase 1.

As a real estate investor, it would be total madness and loss of reason if you were to buy or build a 2 bed apartment in Lekki Phase 1 and rent it out at Ajah prices, you would be committing a financial suicide, same way it would be a complete lack of touch with reality on your part if you were to build or buy a two bed in Ajah and slam Lekki Phase 1 rental price on it. No one will look your way.

When thinking about the price to let your property, always do a quick market analysis, find out how much similar properties are letting in your immediate neighborhood. Your location determines the rental value of your properties.

Your tenants, just like you, are very educated and informed so always apply all necessary wisdom.

If you know that ₦9 million rental income per annum on a 2 bedroom apartment doesn’t cut it for you then I would advise you to move from Lekki Phase 1 and enter Ikoyi, where your 2 bed apartment can fetch you ₦15 million upwards.

As an investor, when investing or buying in a location, bear in mind that at the end of the day. Your rental prices must reflect the location your property is at.

The more developed, expensive and exclusive your location, the higher the rental value of your properties and vice versa.

4🔹 The Income Class

Another factor that determines the rental value of your properties is the income class living in the location your property is in. In my last point I told you that you can’t build or buy in Ajah and charge Lekki Phase 1 rental value, well, why is that?

After all, it is the same Lagos state. It is the same axis, and not too great a distance.

The answer is quite simple, the income class living in the two locations are as different as night and day.

While Ajah is made up mostly of high earning working class citizens and business people, Phase 1 is made up of high earning executives and business moguls. As for Ikoyi, I will describe the income class there in just 2 words, bourgeoisie and old money.

Of course there is some new money in Ikoyi, trying to cozy up to the old money but my point still stands.

The income class in a location is what ultimately determines the rental value of your property which is why when you are investing and building in a location, the house you are building and the amenities and features it contains should reflect and be tailored to the income class in that location.

If you buy land in Ibeju-Lekki for let’s say, ₦40 million and you spend ₦200 — ₦300 million building the house, adding all the bells and whistles. Latest world class technologies, latest world class gadgets and amenities.

I have one question for you, how much are you going to let or sell that house when you are done?

The income class that can afford to let that house from you, are they living in Ibeju-Lekki? Even if they aren’t currently living there, do they want to come down and live in Ibeju-Lekki?

On the other hand if you built such a masterpiece in Ikoyi, slam whatever price you want on it, no matter how high, someone will be willing to pay it. Sujimoto is selling his penthouse at Lucrezia for $14 million. That’s about ₦23 billion if not over because Naira is shit right now..

Earlier today, before I got down to writing this article, I checked out a property in Ikoyi that is renting for ₦180 million per annum and the owner is asking for 2 years rent upfront.

Give me ₦180 million and I will get you a stunning 5 bedroom fully detached duplex in Ajah but someone is asking for that in annual rent in Ikoyi, because he knows the income class that lives there. To that income class, ₦180 million is totally affordable.

No matter how high, take it or leave it, there is someone else out there who will.

As a real estate investor income class is another factor you should really take into account when determining the rental value of your property.

5🔹 Demand and Supply

This is economics 101. When demand is high, prices will go up and when demand is low, prices will plummet too.

One of the reasons why Lagos real estate is so lucrative more than any other part of the country is because of the demand. The demand for houses and apartments whether to let or buy outright is so high.

When there are more people looking for an apartment to rent, landlords will have the morale to call any price they want because they know that even if 10 persons say that the price is too high, there will be one person who will come around and say, ‘take my money!’

When setting the rental price of your property, check the demand for properties in that location. If the demand is high, go ahead and set your rental price high too, someone will take it but if it is not that high and active, then apply wisdom in your pricing.

As long as the demand is high, and supply short, the pressure is on the renters, not you, the owner/landlord. The renters will be competing among themselves for the few houses and will be willing to pay prices far above the average price of properties in that location. This is a situation when you can and should ask for a higher rental value.

On the other hand, if demand is low and supply high, meaning if there are few renters looking for a house to rent and there are a lot of houses/apartments to rent. The pressure is on you, because you are competing with other owners and landlords for the few available renters. This is where you apply wisdom and price your rent competitively.

These are all the 5 factors that determine rental values that you should know and apply when setting the rental prices of your properties, wherever they are.

Am in Nigeria, Lagos, to be specific and even in my examples and analogies I used Lagos state but these 5 factors apply everywhere, in all parts of the world. Whether Dubai, Uk, Singapore, they apply everywhere.

Just personalize them to the location, city and economy.

I am Ugochukwu.