Talking about untapped real estate investment goldmines brings to my mind a conversation I listened to some days ago. I was listening to Alibaba talk and he said that Chief Aliko was visited by some of his billionaire friends, not just your regular billionaire friends, Russian oligarchs to be specific.

They visited him in Lagos and he wanted to take them around to someplace where they could relax, chill and play whatever game billionaires of that calibre play when they hang out, most likely golf but there was no place in the entire Lagos befitting enough that he could take them to.

He ended up just taking them for a short cruise on his yacht, Mariya. This story got me thinking, why doesn’t a city like Lagos have such a facility?

Why has all the people investing in Lagos real estate never thought about establishing something like that?

Why are 94% of all real estate investments in Nigeria being focused on the residential sector?

The truth is that there is a lot more to be done with Lagos real estate. A lot more that should be done by investors of Lagos real estate.

There are lucrative opportunities that are being overlooked by most if not all real estate investors.

Most people when they hear about investing in real estate only think about either buying residential houses or buying land and building residential houses.

But there are other opportunities within real estate. Real estate is beyond just where people live. It is beyond residential. Residential is just one sector of real estate but people treat it like it is the only sector.

There are other sectors of real estate, there is commercial real estate, there is industrial real estate, there is recreational real estate amongst others.

94% of Lagos real estate investors are into residential real estate, the rest are into commercial so what about recreational and industrial real estate?

Why are there not enough people making big moves in these other sectors?

There is something I learnt from one of my mentors, by far the greatest thinker and intellectual of our generation.

He says and I quote, “There is opportunity for you wherever responsibility has been abdicated”.

Anywhere a responsibility has been abdicated, look carefully and in that same place a massive opportunity has presented itself for you. He says this about life but it applies in business too..

In the 1960s Sam Walton started Walmart, a discount store in Missouri Arkansas, at a time when other retail stores like his were focused on establishing themselves in the major cities and expanding their chains there, Sam Walton took a different route.

He focused on the rural areas the other chains were running from. He focused on the overlooked areas.

How did that work for him? Today Walmart is the biggest employer in the world with over 2 million employees. It has over 10,000 locations world wide and for the 2024 fiscal year it reported sales of $648 billion.

This is the kind of results that you get when you take the road least taken.

Now let’s come back to real estate.

What does this story tell you?

While everyone and their mums are doing residential real estate, a massive, massive opportunity lies for you in the other overlooked sectors of real estate investments.

The most overlooked sectors in Nigerian real estate are recreational real estate and industrial real estate.

Nigeria’s real estate market is undergoing a significant transformation. While residential and commercial properties have traditionally dominated the landscape, there is increasing demand and opportunity in these two key sectors.

These sectors are primed for growth, driven by the exponentially growing population, shifts in consumer behavior, evolving economic conditions, and Nigeria’s ambition to diversify its economy.

In this article, I will be diving deep into the investment potential of these two sectors, analyzing their market demand, their opportunities, and the factors driving their growth in Nigeria’s ever-expanding real estate market, starting with recreational and tourism real estate.

Nigeria, among other things, is blessed with a variety of natural landscapes, from tropical beaches to lush forests and historical sites. This has immense potential for recreational and tourism real estate development.

A notable example of an individual who has tapped into this overlooked sector and made waves is Paul Onwuanibe The MD of Landmark Group — the developer behind Landmark beach.

I remember hearing him talk about how he took a helicopter ride around Lagos in 2008 and found an empty large tract of land no one, absolutely no one wanted to buy because back then the place was suffering coastal erosion.

He went ahead and bought the place then developed it into one of the biggest beach resorts and tourist destinations in Nigeria.

I once heard him say that over 20,000 people visit the Landmark ecosystem weekly and the average value of each visitor is ₦5,000. This means that on average, they make ₦5,000 on each visitor. If you do the math you will see that on a weekly basis the cash flow generated is ₦100 million. ₦400 million per month and ₦5.2 billion per annum.

Not bad, not bad at all. Bear in mind that these numbers can be improved either by increasing the number of people visiting or increasing the average value of each visitor.

As you can see this sector remains largely untapped, yet it holds the key to unlocking substantial revenue, both from domestic tourists and international visitors.

Tourism globally is a multi-trillion-dollar industry, with countries like South Africa and Kenya reaping the benefits of ecotourism and adventure travel. In Nigeria, however, the tourism sector has not been adequately harnessed.

Despite the country’s rich culture, diverse ecosystems, and strategic location, there’s a notable lack of world-class resorts, eco-lodges, and tourist infrastructure. This represents a massive opportunity for developers and real estate investors like you to fill the gap and meet growing demand.

There are a lot of beaches in Nigeria that are underutilized. Lagos is an Island which means that there are a lot of beachfront real estate locations, sadly rather than these beachfronts real estate locations being used for recreational spaces they are being used to build water view residential developments.

The demand for recreational real estate is on the rise, especially among Nigeria’s growing middle class and affluent elite. As more Nigerians seek local holiday destinations to unwind, there’s a gap in the market for family-friendly resorts, adventure parks, eco-resorts, and vacation rentals.

For instance, beachfront developments along the Lagos coastline could attract both locals and expatriates seeking luxury experiences closer to home.

Properties like Inagbe Grand Resorts and Leisure have already tapped into this market, but there is room for more developments catering to different tastes — whether luxury resorts or budget-friendly options.

Another potential goldmine lies in eco-tourism and adventure travel. Nigeria boasts rich biodiversity in places like the Yankari Game Reserve, Obudu Mountain Resort, and the Olumo Rock.

While these sites are known, they are severely underdeveloped and their potential is far from being maximized. They are not up to modern standards. They are not developed enough to attract foreign as well as local high spending tourists.

More should be done. Investors like you could create high-end lodges or eco-friendly resorts that cater to visitors seeking natural beauty, wildlife safaris, and adventure experiences such as hiking, canopy walks, and bird-watching.

In Kenya, the Maasai Mara and other wildlife parks have long been cornerstones of the economy, offering luxurious lodges, guided safaris, and cultural experiences that attract high-spending tourists.

Last year alone, Kenya generated $2.7 billion just from tourism. $2.7 billion!

Remember what I said earlier in this article, there is an opportunity where responsibility has been abdicated. Waiting on the government is a fools game in Nigeria. The Nigeria tourism market is there for the taking.

Nigeria’s rich cultural heritage — embodied in places like the ancient city of Benin, the Osun-Osogbo Sacred Grove (a UNESCO World Heritage site), and various colonial and pre-colonial relics — offers a unique opportunity for heritage tourism real estate.

Real estate investors like you can develop themed resorts or historical hotels that immerse visitors in the country’s history and traditions. In Morocco, for example, restored riads and kasbahs have become popular tourist accommodations, drawing travelers interested in architecture and culture.

According to the United Nations World Tourism Organization (UNWTO), Africa’s tourism industry is expected to grow at a faster pace than the global average. For Nigeria, this is an indicator of future demand.

The country already receives adequate amount of international tourists annually, but with proper infrastructure, including world-class resorts, recreational parks, and eco-friendly lodges, the numbers could rise substantially along with the profit generated from them.

Nigeria has a lot of young population, many of these young people want somewhere they can go out and have fun, snap cool photos to post on their Instagram without necessarily leaving Nigeria. This is a growing demand, this is the future of real estate.

Developers and investors who can capitalize on this demand and tap into this growing market eager for more sophisticated, modern facilities that can rival international offerings will make a lot of money.

While recreational and tourism real estate focuses on leisure and culture, industrial real estate is the backbone of Nigeria’s burgeoning economy.

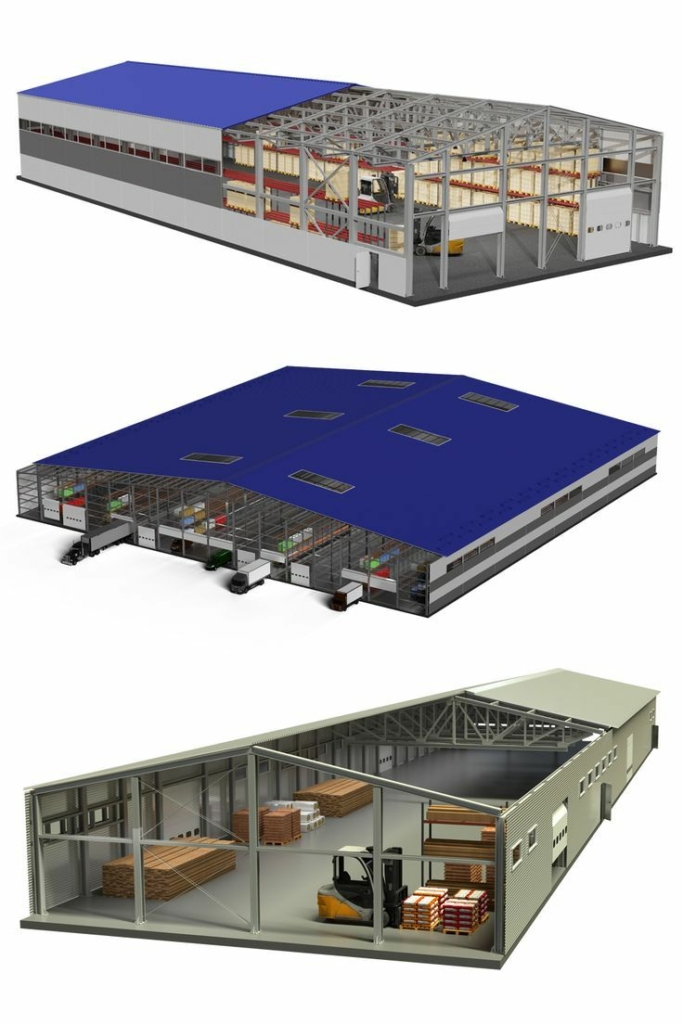

Industrial properties — particularly warehouses — have become some of the most sought-after assets due to the explosion of e-commerce, rapid urbanization, and the country’s push towards economic diversification.

Pastor Matthew Ashimilowo, the developer of Makarios Luxury Place in his wealth masterclass 4 months ago said that he didn’t know the value of warehouses till his church needed one to store things that they wanted to use later for a crusade.

So they started looking for warehouses and that was how he met one real estate investor who bought a large tract of land and built 60 warehouses. 60 warehouses and they were all taken. All!

He said that the guy rents out each warehouse at ₦15 million per annum. If you do the math you will see that that generates him ₦900 million every year.

The thing about warehouses is that they are not fancy, so they are relatively cheaper to build than residential houses. All things considered the guy probably didn’t spend up to ₦600 million on the cost of the land and building all the warehouses and yearly he makes ₦900 million from it.

Apparently the guy has been in the business for 10 years so do the calculations..

Which type of residential housing units can give him that kind of returns? That kind of profit. None!!

Rather than buying acres of land, be it in Epe or Ibeju-Lekki where you know the land will just be there for years before you liquidate, and leaving it empty, why not build warehouses on it and make it available for people to rent and store things?

This way you will be making money from that land while waiting for it to appreciate. This is an ideal way to monetise your investments.

Nigeria’s e-commerce sector is expanding rapidly too, with platforms like Jumia, Konga, and various smaller online retailers driving a significant increase in the demand for warehouse space.

Efficient, well-located warehouses are crucial for these companies to manage inventory and meet the growing demand for fast deliveries, especially in densely populated areas like Lagos, Abuja, and Port Harcourt.

In the United States, Amazon’s success is tied closely to its vast network of fulfillment centers. Nigeria’s e-commerce industry is following a similar trajectory.

Warehousing hubs close to urban centers will not only serve the retail giants but also logistics companies, manufacturers, and small businesses that rely on a strong distribution network to meet the needs of Nigeria’s population, which is over 200 million.

Nigeria’s urban population is growing at an unprecedented rate. As cities expand, so does the demand for goods and services, which places further pressure on logistics and supply chains.

This urban sprawl necessitates the development of strategically located warehouses near ports, highways, and commercial hubs.

Lagos, for example, is the heart of Nigeria’s commerce, but the congestion and limited land supply in the city center make it difficult for businesses to find adequate storage solutions.

Outskirts like Epe and Ibeju-Lekki are becoming prime locations for warehouse development due to their proximity to ports, industrial zones, and road networks.

Investors like you who can position themselves in these high-demand zones and develop state-of-the-art warehousing facilities will benefit from long-term rental contracts and high occupancy rates.

Another opportunity that is set to increase demand in this real estate sector is the African Continental Free Trade Agreement (AfCFTA)

The AfCFTA is expected to bolster intra-African trade, creating a massive need for logistics infrastructure.

As Nigeria positions itself as a major player in West African trade, the demand for warehouses will definitely rise. Investors like you can build large storage facilities in strategic trade corridors such as Lagos and Apapa ports or near border towns like Seme.

Cross-border trade, especially with neighboring Benin, Ghana, and Togo, will require seamless logistics networks. Warehouses located at border towns or free trade zones will play a critical role in meeting demand and ensuring goods move smoothly across borders. This opens up a lucrative investment opportunity in this sector.

Another area of industrial real estate that is gaining traction yet is overlooked is cold storage facilities. Nigeria’s agricultural sector is one of the largest in Africa, but it is plagued by post-harvest losses due to inadequate storage and distribution systems.

Cold storage warehouses can preserve perishable goods like fruits, vegetables, fish, and dairy, enabling farmers and businesses to extend the shelf life of their products and access broader markets.

Developing cold storage facilities not only fills a crucial gap in the agricultural value chain but also creates opportunities for export, especially as Nigeria looks to boost its non-oil exports under initiatives like the Zero-Oil Plan.

One of the main challenges facing Nigerian businesses is the lack of modern, secure, and high-tech warehousing solutions. Older warehouses often lack proper ventilation, security, and digital systems that allow for real-time inventory tracking.

As an investor in this sector, the easiest way for you to distinguish and dominate the market is by developing warehouses that meet international standards, incorporating smart technology such as automated inventory systems, temperature control, and 24/7 security monitoring.

There is no one doing this yet in this sector so this will help you distinguish and dominate in this sector.

These advanced facilities would not only serve local businesses but also attract multinational companies looking to establish a stronger foothold in Nigeria, ensuring high demand and premium rental rates.

While residential real estate is much needed in a country where the housing deficit is over 50 million homes, both recreational/tourism real estate and industrial real estate investments offer significant untapped potential that many people are overlooking.

Recreational real estate developments can harness the untapped potential of Lagos’s natural beauty and beaches, creating resorts and eco-lodges that cater to both domestic and international tourists.

Meanwhile, the demand for industrial real estate, particularly warehouses, is set to soar as the e-commerce boom, urbanization, and trade agreements reshape the country’s economic landscape.

For discerning real estate investors, these sectors present not only high returns but also the chance to contribute to Nigeria’s broader economic development, creating jobs, infrastructure, and sustainable growth.

By focusing on strategic locations, innovative facilities, and meeting the needs of emerging markets, real estate investors can tap into these underexplored frontiers and be part of Nigeria’s next growth phase.

Residential real estate is wonderful, but there are other overlooked sectors where you can make even more returns.

I am Ugochukwu.