Nigeria economy, In June of 2015 the official exchange rate was $1/₦196.95. In June of last year it stood at $1/₦770.38. Am writing this article on the 15th day of June 2024 and the current exchange rate as I am writing this is 1 USD ⇛ ₦1,490.36.

Let’s imagine that there is an alien that likes visiting Nigeria. It came in 2015 and exchange rate was just N195/$. It visited again in 2023 and it was 770/$.

It sat down on its flying suacer and shook its head dejectedly thinking within itself that things are really getting bad, but maybe not that bad.

If it comes this June and found that the exchange rate now stands at ₦1,490.36./$, that’s when it will be confirmed that things are really getting wild and out of control.

Maybe too wild and out of control, without knowing that the ₦1,490.36./$ it is seeing is actually an improvement on the state of affairs being that just about a month ago or thereabouts, exchange was as high as ₦1,900.95/$.

Let’s leave the alien who I imagine is now feeling pretty sorry and shedding big alien tears for Nigerians and talk about, you guessed it, us. Nigerians.

The exchange rate is so unstable that we pretty much work and transact with new exchange rate on a day to day basis. Now, what has been the effects of this development on us, Nigerians?

Well there are different camps. Each camp characterized by their behavior and response to the economic situation.

The first camp is made up of people who are scared out of their minds and like most animals do when scared, they are totally frozen up. Like a deer caught in the headlights.

The second camp is made up of people who have gone into conservation mode. Like a dragon sitting on its horde of gold coins, golden cups and bowls in its lair.

They have retreated within themselves, refusing to make any expansions in their businesses. Refusing to start any new businesses and even refusing to invest their earned income.

The third camp is made up of people who have gone into full panic mode and started selling their assets, ‘to cut my loss’. That’s their words, not mine.

Their actions can best be compared to the Jewish housewife who on hearing that the Nazi were invading the nearest town, went about the house throwing every valuable thing she could lay her hands on inside a bag.

Ready for immediate flight.

Then there is the fourth and final camp who I will call radical optimists. Who are both as calm as bishop and as ferocious as wolves.

Calm as bishop in the sense that they aren’t panicking in any way concerning what is happening, and ferocious as wolves in the sense that rather than retreat and cower, they have made the choice to take the economy head on.

So they have set about identifying opportunities and trying to exploit them. They are actively investing in and growing their businesses and they are actively investing their income buying more assets.

The million dollar question is, which camp do you belong to? Which attitude have you adopted?

Come, walk with me, I promise your legs won’t pain you. Let’s enter the first camp.

First camp; Like a deer caught in the headlights.

Like I said the first camp is made up of people who are so scared that they have totally frozen up. This is the wrong attitude to adopt in this economy, because an animal that freezes up when action is needed gets killed. A deer that sees the headlights of an incoming car and freezes up becomes a roadkill.

I didn’t make the rules, the universe did or in this case, the economic forces did. Choosing to freeze up in fear and indecision is a loosing strategy and a wrong attitude for the current state of the economy.

The current state of the economy is such that one can rightfully say that is aggressively trying to impoverish you on a daily basis.

How?

Inflation is at all time high. Some prices are 3x what they were last year meaning that your money is loosing purchasing power on a daily basis. It is losing value every single day.

The economy is very aggressive, you need to become very aggressive too. Freezing up in fear in this kind of economy is like freezing up in fear before an aggressive bully and you and I both know what happens when you freeze up in fear before a bully.

They won’t show you an iota of mercy or consideration, on the other hand they will become encouraged and turn you into their favorite victim.

Aggression needs to be met with aggression and believe me, nothing is more aggressive now than the Nigeria’s economy.

Let me repeat in case you have forgotten, on a daily basis the economy is aggressively trying to impoverish you. Rolling over on your back won’t help you.

Inaction in an economy like ours is very dangerous. So what should you do? Should you perhaps go dragon mode?

Let’s examine that.

Second camp; On dragon mode

The second camp is made up of people who have decided to eliminate all possible form of risks.

Like a dragon sitting on its horde of gold, they have thought long and hard and decided that they will just sit on their funds and weather the economy like that.

In their fear they have shut down all plans of expansion and growth. In their businesses they have put a pause on any plans of expansion let’s not even talk about investing their income in acquiring new assets.

They have chosen to just shut down and become spectators in the play instead of an actor in the play. But guess what, spectators don’t win awards. No one gives you an award for being on the sidelines and watching.

They make the same mistake as the first camp and that is being weak and docile in the face of an aggressive enemy. Nigeria’s economy is too aggressive right now for this attitude to work.

Deciding to just pull back and weather the storm is a wrong attitude. In your mind you might be saying, ‘Eh but Ugochukwu, being that they are not taking any risks, their money will be with them na. They won’t lose any funds’.

There are some situations in life where not taking action is one of the riskiest options. Nigeria economy is one of such situations because the figure in your bank might remain the same, but is its value really the same?

So once again I ask, what should you do? What is the right attitude?

Let’s enter the third camp.

Third camp; Like a Jewish housewife fleeing from the Nazis

No, don’t worry there is absolutely no need to knock. In their panic they totally left the door ajar, see?

The third camp is made up of people who are in full panic mode. They are liquidating their assets.

Selling off houses without any solid strategy, selling their lands. Houses they bought a year or two ago. Lands they just invested in that has not even come close to maturing.

Some of them are liquidating their real estate assets and buying dollars. Which to me highlights just how precarious their position is, not to mention short sighted because what happens if tomorrow Naira starts gaining against the dollar and continues this trend?

Hear me out, what if tomorrow Naira gains so much against the dollar that it starts selling below 1k/$? What happens then? Do you know how much these people will lose?

That loss they think they can run away from by liquidating their real estate assets pre-maturely will meet them with the full force of a level 3 hurricane.

Buying dollars is a short term strategy that provides temporary relief behind which a very dangerous loss awaits. Like a one night stand with a Lekki prostitute without protection.

Yeah you got f**k*d but then your health and wellbeing could potentially get f**k*d too – for life. Forgive my language but I believe we are all adults here and you and I are on a friendly enough level for me to tell you things as they are without selecting words.

A short term strategy in an economy like the one we are in is a losing strategy. Historically real estate have always, always out-performed inflation. No matter the state of the economy, real estate always recovers. Always.

Panicking and liquidating your real estate assets exposes you to more risks in the long run than holding that property. Liquidating your real estate assets currently is like being stranded in the ocean and drinking saltwater.

Yes I understand that your throat is patched, you are so thirsty it is driving you nuts, hallucinations is starting to set in but by drinking saltwater you reduce your odds of surviving the whole harrowing experience and increase the odds that you won’t survive long enough for you to get rescued by a passing ship.

Don’t go for temporary short term relief. Don’t go into full panic mode and liquidate your real estate assets.

By now I must be sounding like one of these extremely demanding and hard to satisfy individuals you meet at least once.

By now you must be asking, If I, Ugochukwu, don’t want you to go deer in a headlight mode and freeze up, don’t want you to go dragon mode and cower in inaction and indecision hoarding whatever money you have, don’t want you to go panic mode and liquidate your real estate assets. What exactly do I want from you?

That’s quite simple. I want you to go bison mode..

Fourth camp; Like a bison walking straight through a storm

Bison are quite a very interesting animal. When most animals encounter a storm their first instinct is to run away or escape which more often than not is futile because the storm keeps up with them and most don’t survive. Their attempt to escape and run from the storms exposes them to more danger from the storm.

This is where the bison comes in. When a bison notices a coming snow storm. It doesn’t try to run away or escape it, instead it walk calmly towards it. It goes through the storm because it knows that the storm is passing and the fastest way out of the storm is through the storm.

That is why I want you to be like the bison. The current economic situation of Nigeria is a storm that is passing that you need to confront head on. Not necessarily because you are the richest, bravest, or anything like that. No!

It is because by confronting the economic situation head on, matching its aggression with your own aggression you stand your best chance of not only surviving its storms but also thriving.

This brings me to the final camp. It is made up of those who I previously said are as calm as a bishop, no scratch that, as calm as a bison in a snowstorm.

They are not frozen in fear. They are not cowering in indecision and inaction and they are certainly not liquidating their assets out of panic. On the other hand, they are actually on the prowl like a wolf in their industries looking for opportunity to expand their market share, their business and their role in their organizations.

They are actively looking for ways to expand their income, not huddled in the corner from indecision and inaction and guess what they are doing with their assets? They are on the hunt for good deals in the real estate market and buying it up.

Don’t believe me? No wahala, permit me to tender evidence.

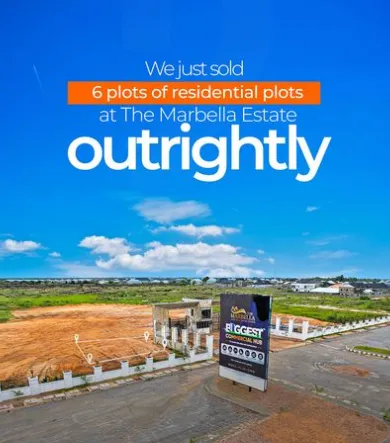

The Marbella is the hottest property in the entire Ibeju-Lekki axis currently. A mixed use estate boasting world class amenities and located directly along the Lekki-Epe expressway, it is the best deal that Ibeju-lekki got to offer.

A residential plot of The Marbella is selling for ₦69.5 million. Mr P bought an acre outrightly. That’s a cash outlay of over ₦400 million.

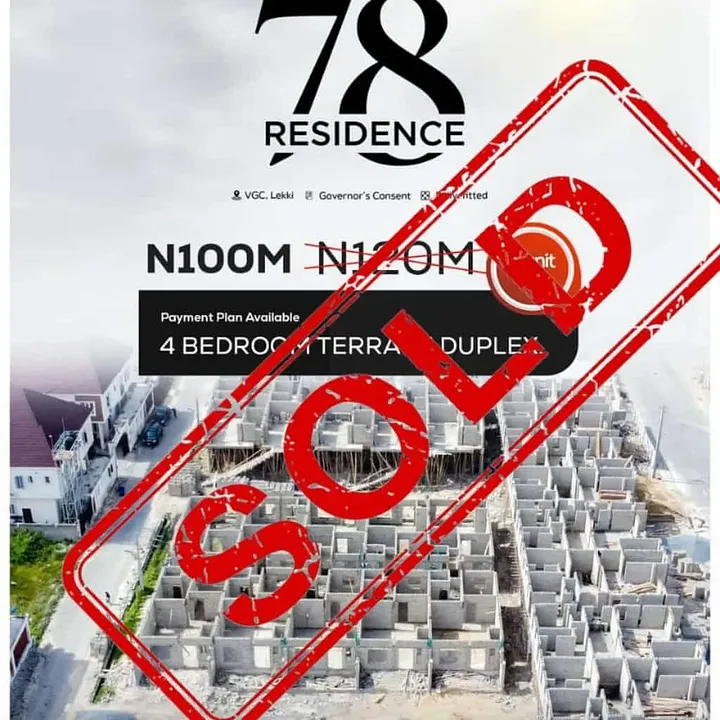

78 Residence. The fastest selling off-plan project in the entire Lekki axis. We offered 10 units for off-plan sales. Weeks later only 2 units remain. This looks rather small when you compare it to the 6 acre above but nothing compared to what I have below.

A commercial plot at Marbella is selling for ₦177 million per plot. A single investor bought 6 and paid outright. A cash outlay of over a billion Naira. This is the right attitude. Nigeria economy is aggressively trying to impoverish you every day, you should aggressively be investing your income.

Aggressively buying inflation proof assets like real estate. You can’t lose money investing in real estate. You can only lose money when you invest short term but as long as you invest long term.

If the economy wants it can fluctuate from Nigeria to Ghana, it will still settle and your investment will appreciate. That the right attitude to adopt in an inflationary economy like Nigeria. That’s the right attitude to adopt in a fluctuating exchange rate.

Keeping your money in the bank in a fixed deposit is a short term move and a losing strategy, interest rate will never keep up with inflation rate.

Get your head out of the sands, stop thinking next year. Next 2 years. Think next 5 years. Think 10 years.

Zig while the population is zagging. Buy while others are selling. Be calm, plan and execute long term while others are thinking short term, panicking and acting out of fear.

Be like the bison. The only way out of the storm is through the storm.

I am, Ugochukwu.