Did you hear the news the news that broke on the 3rd of June or have you been too busy?

The Central Bank of Nigeria on the 3rd of June issued a circular revoking the license of Heritage bank due to the bank’s poor financial performance and position.

As am writing this, there is no more Heritage bank. It is now defunct. Whatever is left of the bank has been taken over by the Nigeria Deposit Insurance Corporation — NDIC.

Which in order to contain the situation and prevent a mass panic while would inevitably lead to a bank run which would , ah God forbid, I don’t even want to briefly entertain the thought of what would happen.

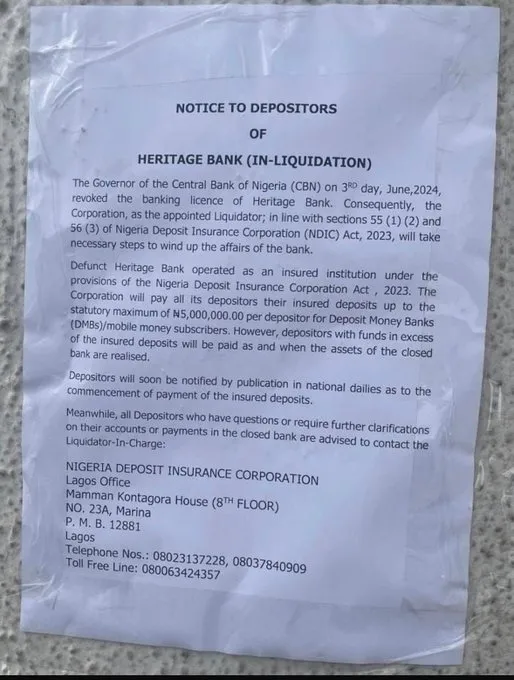

Anyway, the NDIC has promptly assured all customers and staff of the bank that there is no need to panic as their deposit is insured to the maximum statutory amount which was raised recently from N500,000 to N5 million.

This basically means that as far as your money in Heritage bank is below N5 million, you really have little to nothing to worry about. Your money can still be recovered.

But then, what if you happen to be one of these people who have a lot of money and like to stash it in the bank just to feel rich?

What if you have a lot of money and your money with the bank is above N5 million? What if you have ₦10 million, ₦20 million or ₦50 million?

I once overheard someone bragging that his favorite ‘game’ to play on his phone is move a couple of his millions from one of his bank account to another just to remind himself of how far he has come.

So I ask again, What if you had an account with Heritage Bank and your funds with them is exceeding ₦5 million, remember that ₦5 million is your maximum insured amount, what will happen to the rest of your money?

This brings me to the topic of today. When the news first broke, Mercy Eke the season 4 winner of BBN, came to Twitter to lament her fate.

Apparently she had ₦100 million with them on a fixed deposit and now with this latest development her ₦100 million is for the moment in limbo.

Not quite gone but at the same time, not really there. This is because the NDIC has said that anyone with more than ₦5 million deposited in Heritage Bank will be paid “as and when the assets of the now defunct bank is realised”.

…Okay oo. I laugh in swahili…

This is the right thing to do nonetheless as well as the right message to pass to prevent any panic among Nigerians and the erosions of trust in the Nigeria banking system.

Talking about trust in the Nigeria banking system it is time to address the big elephant in the room. Why are you leaving big sums of money in the bank?

Who told you that you should leave big sums of money just sitting in the bank? Who is your financial advisor?

How banks make money with your money

Leaving big sums of money in the bank whether in a fixed deposit or not is the stupidest thing to do, do you know why? Because even banks do not keep your money sitting around. So why should you?

Immediately they use their sale’s pitch to part you from your millions, they put it to work. They send it out to make more money for them.

Let’s go back to the story of Mercy Eke, she said that she was convinced by her account manager to put her N100 million in a fixed deposit which was exactly what she did.

Now, let’s discuss this because this is not an isolated incident..

In fact, it is their favourite modus operandi. It is their favourite method to convince people to keep large sums with them.

They will tell you to put your money in a fixed deposit and they will negotiate with you how much interest they will pay you for that duration.

Now have you ever wondered what they do with this your money? They take it and use it to do business. They put it immediately to work making more money for them.

They give it out as loans, with a higher interest rate than whatever you agreed with them that they will pay you as interest.

They use it to invest in the financial markets. They put it to work immediately with one goal in mind, to make more money for them.

Did you read what I wrote? The key phrase there is , ‘to make more money for them’.

That is the long and short of banks. Their entire business model is parting you from your funds, investing it themselves to make money for themselves.

Now my question is, why must you give the banks this money? Why not invest this money yourself?

Once again let’s go back to the story of Mercy Eke. She was convinced by her account manager to fix ₦100 million and she did. This simply means that she didn’t need the ₦100 million. She had no immediate use for it.

This happens to us all, well not to me, real estate is a very cash intensive business, so give me ₦10 billion, I have a project to start with it.

Bring ₦20 billion, there is a project for it. Anyways, I have to speak generally. So this happens to all of us.

At times we see ourselves with more cash than we know what to do with however instead of taking this extra excess funds and running to the bank like a child with no financial discipline who stumbles on more amount of cash than they know what to do with, why not handle the situation like the smart adult that you are who made his money through his own sweat and tears?

Instead of taking the excess cash that you have and giving it to the bank to invest for themselves, use it to do business for themselves and pay you a fraction of what they made as interests, why not invest this money for yourself? Use it do to business for yourself?

If your business is already operating at maximum capacity or you aren’t ready to expand at the moment, then why not invest that excess funds.

Did I just hear you say that investing the money yourself is risky?

Well, as the story of Mercy Eke shows, so is leaving it in the bank.

Besides this, investing your money really is not that risky. Not when you use it to buy real estate. Not when you invest it in real estate.

Investing in stocks can be very risky and you can lose your money because the price can be very volatile.

Investing in cryptocurrency can be very risky because price fluctuates on a daily basis like the speedometer of a car on the highway.

But investing in real estate in a developing country like Nigeria? Truth is that nothing, no investment is entirely without risks but acquiring a genuine property in a developing economy like Nigeria is the safest it can ever get.

This is because in a developing economy like Nigeria’s. Things are always going up. There are so many infrastructures yet to be built. So many things yet to be put in place that the best of the economy is still to come.

This means that any property you buy today, tomorrow it will be worth much more. Much, much more.

If you have an excess ₦100 million or above that you don’t need at the moment, That you have no immediate use for at the moment, instead of giving it to the bank, use it to acquire houses in Lagos. You can then rent out this house(s) on an annual basis or use it for shortlets.

In certain neighborhoods like Lekki phase 1, Ikeja GRA, Magodo, Ikoyi and other high-end neighborhoods the annual rent varies from ₦10 million to ₦30 million for Ikoyi while the daily rate for shotlets in the same neighborhood vary from 250k/day to as high as N500k/day for Ikoyi.

So now you have two ways you are making money. You are making money either from renting the property out on an annual basis or daily basis if you use it to run a shortlet business.

At the same time the property is appreciating in value. You are making money from the cashflow and the property is still appreciating meaning that whenever you are ready to sell, you will sell it much higher than the amount you bought it.

There are so many others ways to invest your hundreds of millions in real estate. For example, if Mercy Eke had reached out to me last year February or even March and told me that she had ₦100 million she wasn’t using, I would have made ₦90 million extra for her by now.

How? You ask. It is quite simple.

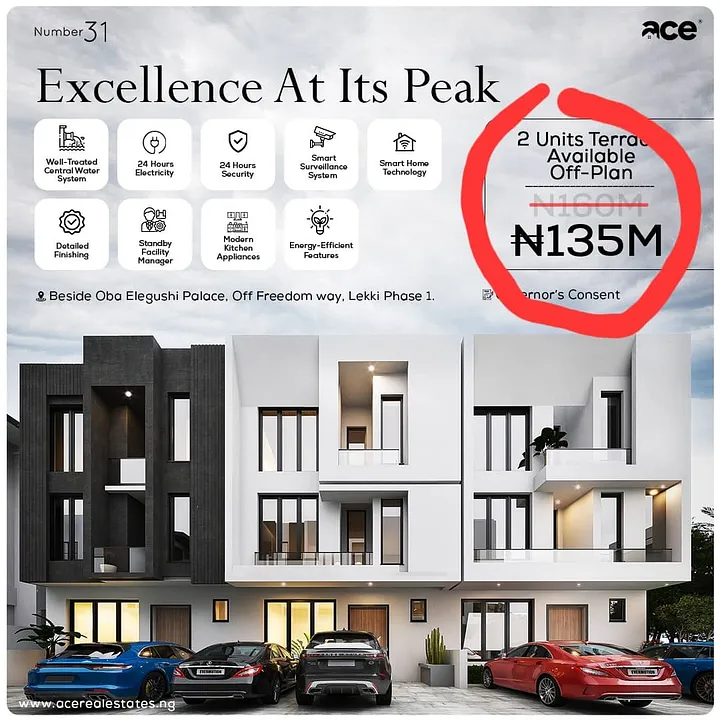

Last year we launched a new project at Lekki Phase 1, just behind The Monarch events centre. We named the project Number 31.

Number 31 consists of 6 units of 4 bedroom luxurious terraced duplex and a unit of a fully detached ultra modern 5 bedroom duplex. We sold 2 units of the 4 bed terrace duplex off-plan at ₦135 million each.

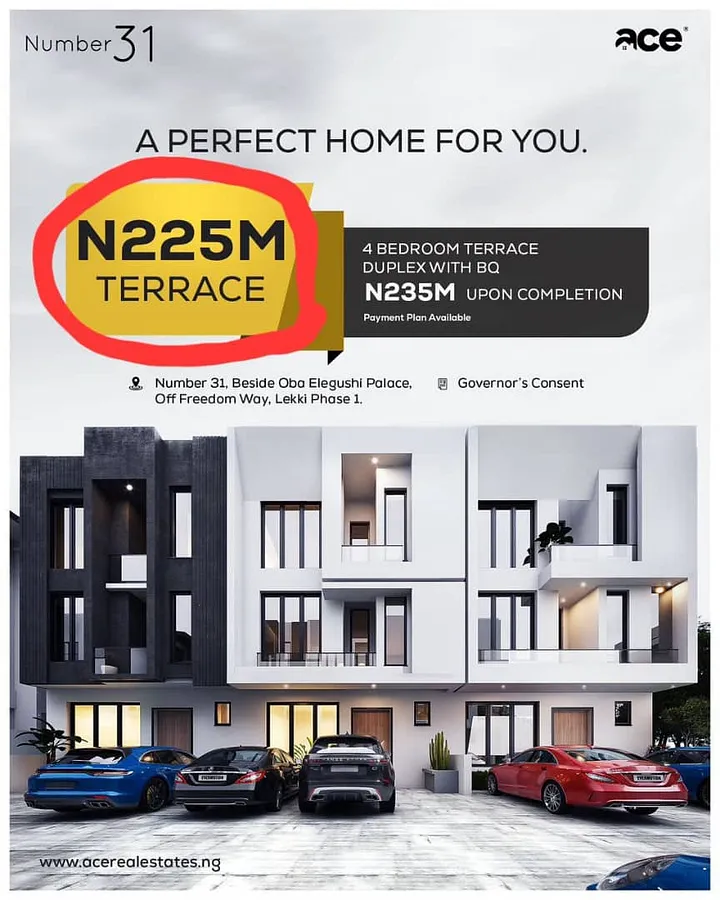

Today this project is almost completed and guess the market value of these 4 bed terrace we sold off-plan then for ₦135 million?

₦225 million! Upon completion they are expected to be selling for N250 million.

If she had gotten in touch with me, I would have gotten her a unit of this 4 bed terrace duplex at ₦135 million, after they are completed, I will resell it for her for ₦250 million. A profit of ₦115 million.

As you can see above, the lowest price of a bedroom terrace duplex at Lekki Phase 1, off Freedom Way where Number 31 is located is ₦160 million but this is for houses built on small tiny plots of land and with the cheapest, most inferior materials. Not for a luxury project like Number 31.

Average price of 4 bedroom terrace in this neighborhood is ₦250 million and price can even go as high as ₦400 million.

So do you see that there is even a possibility that I can resell it for her higher than ₦250 million?

Or she can choose to rent it out or use it for shortlets. Rent per annum in this neighborhood is ₦15 million per annum while short let is ₦250k/day.

There are 365 days in a year but it is not feasible that she will be booked out every day of the year so let’s talk worst case scenario, worst case scenario is that she gets booked for only 100 days out of the 365 days.

That’s a healthy ₦25 million per year from shortlets.

But

She didn’t reach out to me. Instead she gave the ₦100 million to Heritage Bank and now Heritage Bank is no more and when all is said and done, she might be able to only recover only a fraction of the full amount. Just a fraction. Remember, the maximum insurable amount is ₦5 million.

She missed but the million dollar question now is, what about you?

Will you continue, like a clueless child who stumbled on money, to leave your money sitting idle in the bank database actively working harder and making money for the bank and their shareholders or will you instead act like the smart, shrewd adult that you are, take your money and invest it yourself in safe assets like strategically located and fast appreciating real estate properties?

Permit me to remind you that you didn’t get this far in life by being timid. No! Not at all. You got this far by being smart and bold in your choices among other things.

If you are tired of making the banking class richer off your sweat, if you are ready to put your money to work, working for you instead of working for the bank, click on the button below to send me a WhatsApp message.

We are unveiling a new project soon in Lekki Phase 1 and you can’t afford to miss this.

Don’t be like Mercy Eke, get your excess money out of the bank and invest it in real estate. Years from now you will be thanking the day you came across this article.

The day you heard about Ugochukwu.

I am, Ugochukwu.