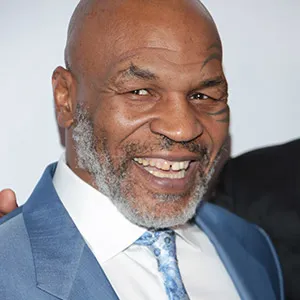

Talking about money habits, in 2003 the whole world was shocked when Mike Tyson who is not only one of the best heavy weight boxers of all time but also one of the best paid filed for bankruptcy.

How to Invest and Compound ₦1 Billion in Real Estate – A Must Read.

Who could believe it? After all Mike Tyson had reportedly earned over $400M throughout his career. Which is about $935 million when adjusted for inflation today.

How can someone blow through a fortune like that in a lifetime? The funny thing was that Mike Tyson didn’t even need a lifetime to blow it. He did it in less than 20 years.

As incredible as the story sounds Iron Mike as he is popularly called is not alone. In fact, bankruptcies are so common among athletes, actors and comedians that no one bats an eyelid anymore when a new story pops up.

Nicholas Cage, Vince Young, John Daly, Dennis Rodman to mention are few were once household names that went ahead to spend their way into bankruptcy.

How is this possible? These people make more money in a year than 95% of people make in their lifetime. How are they blowing through it this fast?

The answer is simple: bad money habits.

The secret about money

The secret about money is that it is not about how much you are making. It is never and has never been about how much you are making.

There was this man I heard about. He was the CEO of a big company. He makes ₦20 million a month but his expenses per month on average is ₦25 million. What do you think happened when he lost his CEO position?

His world crumbled around him faster than Usain Bolt could run a 100 metre race. Why is that? He was used to living on a budget of ₦25 million per month which was ₦5 million above his monthly income so he was spending more than he was earning.

When he lost his position the money stopped coming in. He had debts here and there and his life unraveled right before his eyes because all of a sudden he couldn’t afford the fancy dinners, rides, watches and clothes he used to indulge himself in.

When he reached out to his friends for financial assistance, the news quickly spread that he was financially distressed. His was deserted like a leper and he stopped getting invites to the exclusive events, membership restaurants and clubs that until his sudden challenge had been his playground.

Now compare him to Joe who makes just ₦1 million per month. Spends ₦600K. Saves 100k and invests 300K every single month.

Do you think that if Joe loses his job tomorrow that he will ever feel it?

Do you think that he will ever be so financially desperate to go about begging his friends for help?

What is the difference between these two people? Their money habits.

Joe has a good money habit because he lives below his income. Saves 10% of the income and invests 30%. Though he makes just ₦1 million monthly, he is richer than the ex-CEO who despite the fact that he was making ₦20 million monthly was spending ₦25 million.

Many people when the money is coming in hard and fast only think about the next fancy thing to buy. The next car. The next gadget.

They make the mistake of thinking that the money will keep coming in like that for life.

But the truth is that it never does. People get old and lose their strength thus reducing their earning capability .

People lose their jobs. Their businesses. Bad things happen and they don’t announce their coming. More often than not these things happen suddenly and if you have poor money habits you will be swept under immediately.

When the money is coming in hard and fast the best thing to do is to save some of it, and invest as much of it as you can.

In the Bible during the 7 years of plenty, Joseph stored so much food that during the 7 years of famine that followed Egypt made so much money selling the food that was stored they became extremely wealthy and powerful.

If they had eaten everything in their time of plenty, they wouldn’t have anything to sell to people during the time of famine. Not only that, they themselves would have starved.

So in times of plenty, don’t eat all. Save some and invest for tomorrow. Provide for tomorrow, today. That is what investment does for you.

There are so many investment opportunities out there but you have to be careful so you don’t lose your money to heartless swindlers and system. You have to be strategic.

What should you invest in? Should you buy stocks? Or crypto?

On the 19th of October, an acquaintance of mine bought 4 Bitcoins for $260,000. That is $65,000 each. What happened next is the stuff that nightmares are made of.

4 Wealthy Reasons You Should Invest In Real Estate Today!

The crypto bubble burst and bitcoin started falling. He said that he would HODL( hold on for life) but when it finally fell below $30K he couldn’t bear it anymore. He sold it off. He bought 4 bitcoins for $260k and sold them at $120k. So he lost $140K.

At current Naira to Dollar rate that’s over ₦120 million in Naira. That is why you have to be careful when choosing where to invest your money.

Investing your money in an asset that can lose or gain value based on one Elon Musk tweet or one breaking news headline is not a safe investment for you.

Joseph Adefarasin, the father of Paul Adefarasin of House on the Rock church used £2,000 to buy land at Akin Adesola ( now Victoria Island) many years later that same piece of land was sold for $5 million.

The woman in the news article above bought for 1.5 million. 15 years later the plot of land sold for N90 million naira.

Imagine if she had the money and bought an acre or 2 acres.

As far as investments are concerned, nothing beats real estate.

Since biblical times, whenever God wants to bless people he gives them land. That is because land is wealth. When he wanted to bless Israelites he didn’t rain gold and silver on them.

He gave them the land of Canaan. A land of ‘milk and honey’.

Land is wealth because it is limited in supply but demand for it never ceases.

In Manhattan, New York, there is no more land so guess what they are buying over there now? Air rights.

Which is basically permission to keep adding more floors to skyscrapers.

In Dubai there is very short supply of land that is why expensive land reclamation projects like the Palm Jumeirah among others are coming up over there.

This is why land is the best investment you can ever make. You will never lose money. You can never lose money.

Investing in land is like planting a seed of corn. Weeks later that single seed will grow into two or more full corn.

It is the same thing with buying land.

Some people when they hear about buying land feel like it is a luxury. Something one does when they have hundreds of millions in the bank.

Some people even prefer to be seeing the money in their bank balance. It makes them feel rich, and secure.

That is funny to me. Truly funny to me because their is absolutely nothing secure about having your money just sitting in your bank account.

The first golden rule of wealth is that the money you make must be making more money for you if you want to be truly wealthy.

Your money in the bank is not making money for you. It is losing value due to inflation and making money for the bankers because they will take it and loan it out to other people at attractive interest rates.

Bankers use the money you keep in their bank to make money while inflation is eating it up.

Your savings in the bank should be causing you distress not making you happy when you look at them.

By this time last year a litre of petrol was selling for ₦158/litre. With ₦10 million you could buy 63,291 litres of petrol.

Today petrol is selling for 617/litre. ₦10 million gets you only 16,207 litres,

Same ₦10 million but the purchasing power has greatly decreased. That is inflation.

Money you have in the bank is losing value. That is why you should take your money out of the bank and use it to buy land.

In 2019, you could get a full plot in Ibeju-Lekki for 500k, ₦1 million.

Today lands in the same Ibeju-Lekki is selling for ₦26 million, ₦50 million. Who knows what they will be selling for 5 years from now.

This is why you need to get your money out of the bank and use it to buy real estate.

Good money habits like spending less than you are making. Investing smartly by buying land will not only make you wealthy, but will help you build and pass down multi-generational wealth for your kids.

Like the saying goes, ‘buy land, they aren’t making it anymore’.

I am Ugochukwu.