In my book, ‘How to become a land banking billionaire’.

I told the real life story of Joseph Adefarasin, the father of Paul Adefarasin and how he built a multi-generational wealth for his family from a £2,000 land investment.

If you are among the people who have read the book, you will remember that after using his entire retirement savings which then was £2,000 to buy land, he didn’t have any money left to develop or add any value on the land.

A real estate company approached him with a proposal to build on his land and after a period of 10 years, the houses would become his.

They agreed and signed.

The company built houses and rented them out, after 10 years those houses and of course the land were transferred back to Joseph Adefarasin and became his.

In real estate, we call this a ‘Joint Venture’ or JV for short.

Real estate joint ventures are arrangements whereby one party provides land and another party provides the funds, management and project expertise to develop those lands; at the end, both parties share profits based on a previously agreed format.

In simpler terms, joint ventures simply means that you have land and someone else (a property developer) has the money.

They build on your land and at the end of the development you two will share the money made from that project or the ownership of the entire project will be transferred to you after a certain period of time.

Alaro City, one of the biggest real estate project currently driving development in the Ibeju-Lekki/Epe region is a JV between the Lagos state government and Rendeavour, a multi-national real estate development company.

Even the Epe film city, a $100 Million project that is also a major driver of development in that same axis is a JV between Lagos state government and Del-York.

In both these instances, Lagos State government is providing the land while the companies are providing the funding, vision and expertise.

These are notable examples however as you should already know, JVs aren’t just between governments and foreign companies.

It is common among individual landowners too.

Most developments happening in locations like Lekki, Ajah, VGC, Ikeja currently are joint venture deals.

📍Why joint ventures (JV) for you as a landowner?

Why not just sell the land outright?

As a landowner joint ventures are much more profitable for you than selling the land outrightly.

For example let’s say that your land is valued at ₦100 million, should you sell it outright that’s the amount you will sell it but with a Joint venture you can easily make ₦150 million to ₦200 million from the same piece of land.

Or if you are like Joseph Adefarasin, you can even eat your cake and still have it.

How can you as a landowner make twice the value of your land or eat your cake and still have it from a joint venture deal?

I will explain that shortly but before that,

📍Why joint ventures (JV) for developers?

Why don’t they just buy the land and build?

Joint ventures make it much cheaper for developers to get started on their real estate projects.

Why spend ₦200 million on just buying land at Lekki for the house(s) you want to build when you can sign a JV deal with the landowner, add the 200M you would have paid for the land to the capital you have so you can deliver a bigger, better project, start working on the project and pay the landowner after your project has been delivered and sold out?

JV is a better arrangement for both property developers and landowners because it enables the landowners to make more money from their land and it saves the developers much needed funds.

It is a win win arrangement for both parties.

Earlier in this article I told you that as the landowner in a JV deal, you can easily make twice the value of your land or even eat your cake and still have it.

How is that possible?

There are two types of JV arrangements, we have the build and share model and the build operate and transfer model.

Let me analyze the two models one after the other starting with the build and share model.

📌The build and share Joint Venture (JV) model:

This is arguably the most popular and widely practiced model.

It is a type of JV arrangement where the landowner and developer agree to share the total value of the project.

The sharing formula could be 60/40, 60% for the developer and 40% for the landowner.

It could be 70/30.

For example let’s say that you have 2000sqm of land that is worth 300M, the developer wants to build terraced duplexes.

Upon completion the whole project is now worth 2B.

On a 60/40 sharing formula you are walking away from the deal with 800M.

On a 70/30 sharing formula you are walking away with 600M.

The sharing formula could even be 90/10.

90% for the developer and 10% for the landowner.

It all depends on the value of what the developer wants to build on the land.

If your land is valued at ₦300 million and the project to be built will be worth N5B.

This means that on a 90/10 sharing formula you are walking away with 500M.

No developer will agree to a 50/50 split in case you are wondering, because to be honest, they are taking the major risk and responsibility.

They will provide the funds, they will provide the expertise, vision, marketing and selling of the project when it is delivered.

Some of the factors that determine the sharing formula include the value of your land, the cost of the project and the expected worth of the project upon completion.

📌The build, operate and transfer Joint Venture (JV) model:

In this type of JV arrangement, there is no sharing whatsoever involved.

In this model, the developer builds on the land, uses it for an agreed upon period of time after which the ownership of the land and whatever has been built on it will be transferred back to the landowner.

In order for the developers to recoup their funds and make profit during the period the land is under their use, they need to commercialise it.

For example let’s say that you have a piece of land that is in a prime location, so you sign a build, operate and transfer JV deal on it authorising the developer to build a hotel, mall, plaza or even residential duplexes( strictly for rental, not to be sold) and use it for a period of let’s say, 12 years.

After that 12 years the ownership of the property (the land plus whatever structure has been erected) will be transferred back to you. To do with as you please.

This is how you eat your cake and have it, with extra because you are getting back your land that has not only been developed, but also commercialised which means that it can easily be worth 50X, 70X of its original value before you signed the JV .

This is the JV arrangement that Joseph Adefarasin had with the company that built on his land.

They developed and used his land for 10 years after which the ownership was transferred back to him and he started collecting rent because the company built houses which they rented out.

The period of time the developer will make use of the land is determined by the cost of the project and how long they estimate it will take for them to recoup their capital as well as make profit.

So it varies, a lot.

The Lekki deep sea port is a build, operate and transfer Joint venture deal between the federal government, Lagos state government, Tolorams group (developers of Lekki Free Trade Zone) and China Harbour Engineering Company.

Am not privy to the full details of the arrangement so am not aware of the time duration but after a certain period of time, the ownership and control will be transferred back to the government.

When doing JV deals you might hear words like Premium and sign on fee.

Premium which is like a proof of funds.

For example let’s say that a property developer reaches out to you for a JV, wants to develop a project worth 2B on your land, you can ask him to pay 100M as a premium.

This fee exists for one purpose only and that is to show that the developer is financially capable of completing whatever project he starts on your land.

This however is optional, not all JV arrangements come with Premium fees.

In JV deals there is also what is called a sign-on fee which is simply money that a developer must first give to the landowner before starting any work on the land.

As a courtesy and appreciation for allowing them to work on the land.

All JV deals come with a sign on fee but the amount varies.

These are pretty much all you need to know about Joint ventures.

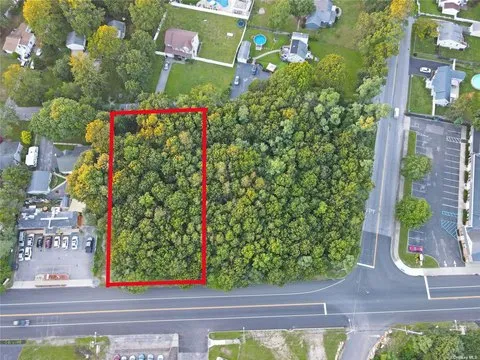

95% of people who had the opportunity to buy Lekki but didn’t and missed a life changing opportunity solely because Lekki is a waterlogged land and they feared the cost of sand filling the land.

However the few who were courageous enough to make the investment were able to build generational wealth for themselves.

98% of them never undertook the cost of building on those lands, instead they sold the lands outrightly while the luckier few signed JV deals, thereby maximising the returns they got from their investment.

Never ever allow the fear of an unknown future to hold you back from a real estate investment because there are just so many opportunities in real estate.

So many ways you can liquidate or leverage your investment.

For those that acquire lands, Joint ventures representative the best way to maximise the returns on their investment.